The Role of Due Diligence Software in Modern Business

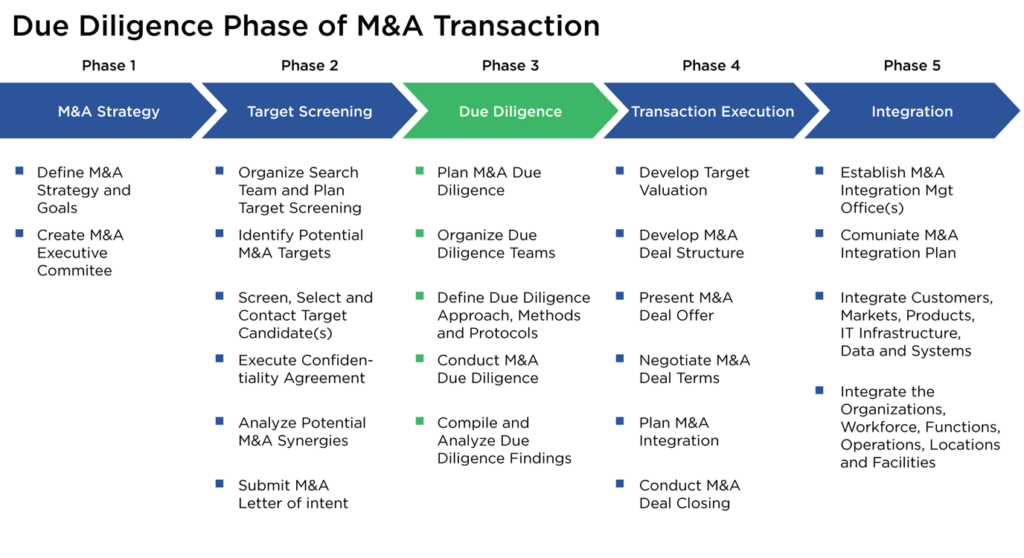

It is imperative that we delve into the very definition of comprehensive legal due diligence software within the context of contemporary business transactions, which transpire almost on a weekly basis. Due diligence, a thorough evaluation and analysis of potential deals or investments, serves as a paramount safeguard against uninformed decision-making. It can be posited that this constitutes the initial phase of departure for executing various forms of intricate business transactions, including those previously discussed. The amalgamation of m&a activities, intricate normative-legal frameworks, and complex financial mechanisms necessitates a systematic evaluation process. This stage, in fact, proves to be intricate, as a plethora of research on this subject indicates that a considerable number of errors are made during this phase.

It is precisely within this context that the role of software for conducting comprehensive legal analysis becomes evident – a pioneering solution enabling organizations to navigate these intricacies with heightened efficiency and discernment. Undoubtedly, the fact remains proven that a significant number of entrepreneurs have notably enhanced their decision-making indicators and reduced errors when undertaking comprehensive legal due diligence, a development that is certainly heartening.

In the landscape of modern business, there exists an expansive array of scenarios wherein software for conducting due diligence assumes an indispensable role. Furthermore, software solutions are currently expanding their horizons to provide optimal solutions for each of the proposed transaction scenarios. These encompass mergers and acquisitions, joint ventures, partnership agreements, and investment prospects. All these are tailored in accordance with user experience, particularly beneficial for newcomers lacking any prior exposure to such transactions.

By leveraging software designed for comprehensive legal due diligence, modern business can meticulously scrutinize financial data, legal documents, documents substantiating regulatory compliance, and operational metrics. This notably expedites the process of navigating any form of business transformation, traditionally deemed intricate. This assurance ensures that decisions taken are grounded in a comprehensive understanding of the target company’s strengths and weaknesses, opportunities, and threats. As discernible, this stands as one of the most promising applications in the realm of business operations.

Key Features and Functionality of Effective Due Diligence Software

The efficacy of software for due diligence is contingent upon its multifaceted attributes and functional capabilities, which collectively elevate the due diligence checklist process to unprecedented heights. Foremost among these functionalities is the capacity for report generating. Within these reports, voluminous datasets undergo transformation into easily comprehensible information, thereby enabling decision-makers to promptly identify critically vital insights that underpin their subsequent data organization operations. This stands as one of the most effective methodologies for substantially enhancing a company’s metrics within a succinct timeframe.

Another distinguishing facet of effective software designed for conducting comprehensive legal scrutiny pertains to the provision of a detailed checklist. This innovation encapsulates a multitude of contemporary technologies, constituting a structured framework facilitating users’ traversal through myriad components of comprehensive assessment without overlooking any salient aspect. Moreover, collaboration features embedded within the software ensure seamless communication among stakeholders, thereby enhancing cross-functional interaction and expediting decision-making timelines.

Furthermore, user permissions, access rights and document indexing mechanisms contribute to the preservation of data integrity and confidentiality. This functionality was integrated in response to a plethora of requests from entrepreneurs of diverse calibers. The allocation of access rights serves to confer confidential information solely to authorized personnel, safeguarding its confidentiality. Document indexing expedites the retrieval of pertinent data, thereby amplifying the overall efficiency of the due diligence software process.

Streamlining Due Diligence Processes with Software Automation and Enhanced Data Security

Due diligence tools function as a catalyst for process optimization through the automation of software operations. In reality, this category of application has long held a preeminent position in automating the majority of business processes undertaken across a diverse spectrum of companies. The automation of routine tasks not only expedites the timelines of due diligence procedures but also mitigates the risk of human error. This indeed constitutes the primary advantage prompting entrepreneurs to invest in this corporate solution, thereby elevating overall efficacy levels. Automated workflows facilitate seamless information exchange at various stages of due diligence, optimizing resource allocation and bolstering productivity. Furthermore, the enhanced level of transparency engendered by such automation elicits investor confidence, motivating them to collaborate with you upon learning of your possession of such software, facilitating the most efficient and expeditious partnership. Conversely, investors tend to steer clear of those entrepreneurs still reliant on conventional and traditional software without reporting and analytics.

Concomitant with process optimization, due diligence software solutions prioritize data security and regulatory compliance. Robust encryption protocols and secure file sharing mechanisms safeguard confidential information against unauthorized access or leakage. Verification of these assertions is possible through the acquisition of trial versions, which are often provided at no cost. The data tracking capabilities intrinsic to the software permit document tracking, thereby ensuring transparency and accountability within the due diligence process.

Best Data Management Software for Due Diligence

In truth, numerous instances of automating the complex legal due diligence process abound. Among these, one can consider the exemplary offerings such as iDeals online data room, a favored choice among a considerable number of entrepreneurs, operating both within the United States and Europe. Similarly, noteworthy platforms include DealRoom and DD360, esteemed by entrepreneurs for their extensive array of frameworks dedicated to automating intricate processes. Additionally, prominent names such as ShareVault and Nexis Diligence stand as pertinent examples. This exemplifies the vast array of applications available, affording you the flexibility to select the right due diligence data room provider from a range of options that best align with your company’s operations and your individual preferences.

Summary

Within the contemporary business landscape, the indisputable efficacy of due diligence software is resoundingly evident. Its transformative potential encompasses an augmentation of decision-making efficiency, process optimization, automation, and data safeguarding. Harnessing the capabilities inherent in software tailored for comprehensive legal scrutiny empowers organizations to adeptly navigate the intricacies inherent in modern business operations, ensuring that each strategic stride is firmly rooted in meticulous analysis and informed judgment.