Understanding the Importance of a Due Diligence Report

The due diligence report identifies several components of a firm that aid in moving forward with any traction planned for the future growth of both parties concerned.

Here are a few major advantages and the importance of due diligence of conducting due diligence before any transaction:

- A detailed report aids in understanding the organization and its future goals to generate additional monetary or non-monetary earnings.

- A perfect due diligence report is ready to serve’ document that explains the status of numerous concerns at the time of purchase/sale, etc.

- It provides a holistic view of the company’s current state and how it will perform in the future.

- The due diligence report assists an acquirer in identifying and understanding the risks, obligations, and problems that exist in the company prior to concluding the transaction.

- It also aids in the avoidance of losses and poor outcomes in the future. It’s always preferable to know the present before planning for the future, as the saying goes.

It is done with consideration for both the buyer and the seller.

Gathering and Analyzing Relevant Information

A company’s due diligence team will often drive the investigation, compile the due diligence data, and create the report. Attorneys for a company will also be involved.

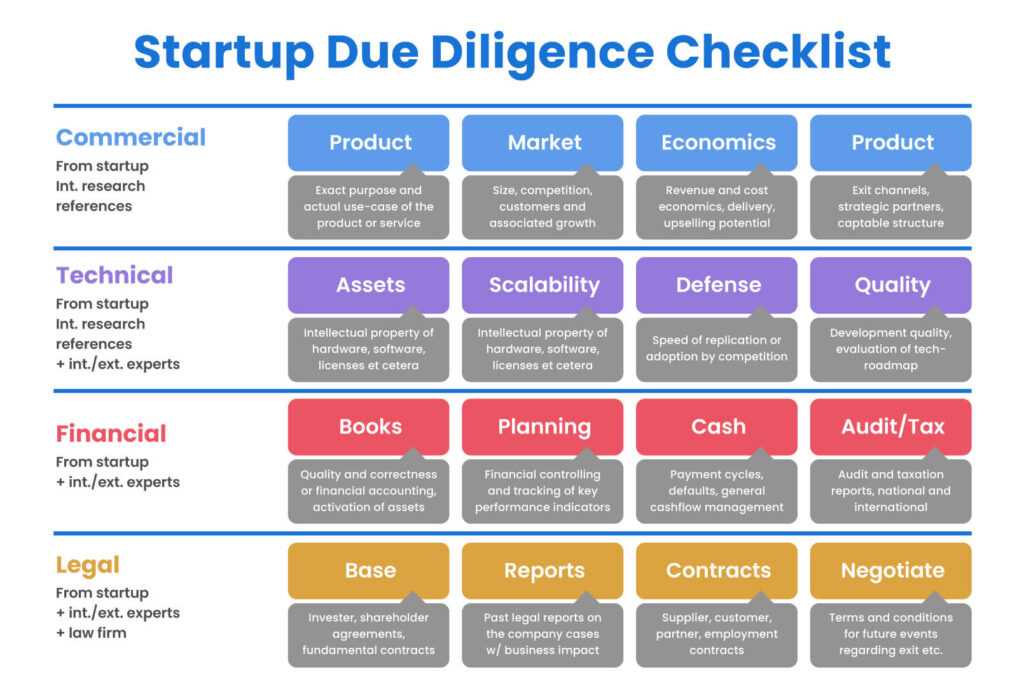

Here are the main types of due diligence reports for information gathering and analyzing

- Financial Statement Analysis: Evaluating the Financial Health of the Target Company

This section validates financial, operational, and commercial profitability assessment. This gives the acquiring firm a great breath of comfort. Accounting policies, audit practices, tax compliance, and internal controls are all thoroughly reviewed here.

- Legal Analysis: Identifying Legal Risks and Compliance Issues

It primarily addresses the legal aspects of a transaction, as well as legal dangers and other legal difficulties and risk assessment. It applies to both inter-corporate and intra-corporate transactions and the intellectual property. Along with the current legal documents review, this diligence includes many regulatory checklists.

Assessing Business Operations and Market Positioning

A due diligence report’s purpose is to provide a clear and objective assessment of the target company’s strengths, weaknesses, and potential dangers. The following are some main purposes of a due diligence report:

- Evaluating Efficiency and Effectiveness of Business Operations

The target company’s financial performance is an important part of due diligence. The financial statements of the company, including balance sheets, income statements, and cash flow statements, should be examined in the report. This examination should include supply chain management, process evaluation, manufacturing operations, supply chain assessment, product development, and customer service.

- Analyzing Competitive Advantage and Market Share

The due diligence report should include a market positioning assessment study of the target company, including customers, competitive landscape, and industry trends. This study should assist the buyer in comprehending the target company’s market potential, industry trends as well as the competition landscape.

Evaluating Risks and Opportunities for Future Growth

Making informed judgments, reducing risk, and maximizing value in commercial transactions all depend on thorough due diligence. Parties can recognize potential dangers and possibilities of the economy performance, improve negotiations, and safeguard their interests by implementing a rigorous due diligence process.

Companies and investors must modify their due diligence procedures as the business environment changes of the industry growth prospects in order to take into account new risks, opportunities, and trends.

Businesses can improve their decision-making process, maximize their performance and the SWOT analysis, and accelerate their growth by remaining proactive and adjusting to change.

Real-World Examples of Compelling Reports

Let’s examine some successful cases that involve the correct execution of thorough assessment and the creation of an accurate and appropriate report about their activities.

- We can look at one of the most significant merger and acquisition deals that shook the year 2022. We’re talking about the acquisition of Activision by the larger corporation Microsoft. While for consumers, Activision was a struggling company that hadn’t been effective in its field for a long time, Microsoft conducted thorough analysis through comprehensive assessment, recognizing fading potential in the company. Even now, this deal continues to benefit Microsoft greatly, just under a year later. It’s the detailed report that helped create an atmosphere unlocking new possibilities for the existing corporation.

- Another example of solid reporting can be seen with Broadcom. They recently absorbed another tech company focused on virtual visualization technology. Both VMWare and Broadcom made significant efforts in creating the most comprehensible report through comprehensive assessment. Without this, they wouldn’t have been able to execute such a globally renowned deal, potentially bringing billions of dollars in extra profit to the acquiring company. The analysis of their operations is the key factor in the final decision.

- Finally, we can delve into less conventional examples of acquisitions in the modern business world. A major company like Oracle, which centers around modern technology and Java development, surprisingly acquired a healthcare-focused company. Through comprehensive analysis, they saw potential in the future growth of the corporation by acquiring Cerner. A well-constructed report from both sides allowed them to view this situation from various angles, modeling potential company growth and overall profit increase.

You can clearly see how crucial comprehensive assessment is for the merger and acquisition process.

Due diligence is an important step in any corporate transaction, and a due diligence report is an essential component of the process. The study includes a thorough and unbiased analysis of the target company’s strengths, weaknesses, and potential threats. It is critical to have a checklist that covers all the essential components of the organization to ensure a full and effective due diligence procedure. By doing efficient due diligence, the buyer can make educated decisions and negotiate a fair price for the transaction, while the seller can discover areas for improvement and increase the company’s worth.